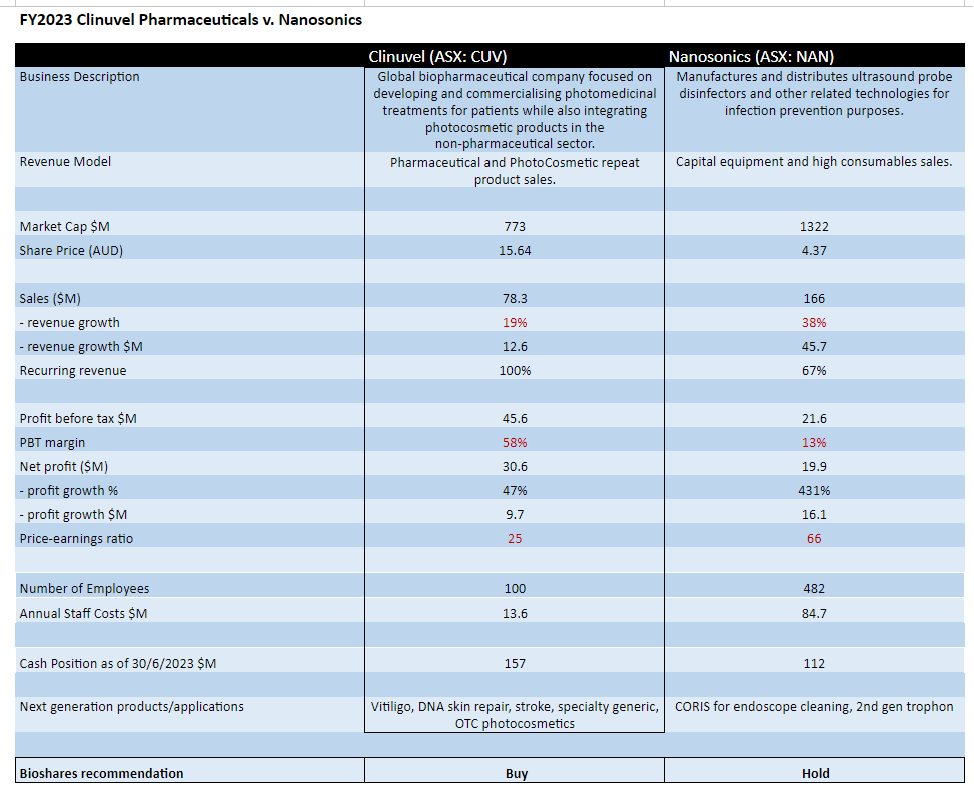

Two highly successful life science companies that have emerged in the last decade in Australia are Clinuvel Pharmaceuticals (CUV: $15.64) and Nanosonics (NAN: $4.37). Whilst one is a pharmaceutical company and the other sells medical products (the Trophon disinfection instrument for ultrasound probes), there are several commonalities between the two businesses which make a comparison worthwhile.

From a top line assessment, Nanosonics generated revenue of $166 million last financial year (up 38% from the PCP) compared to Clinuvel which achieved sales from its drug Scenesse of $78 million (up 19% from the PCP).

However in terms of the bottom line comparison, Clinuvel's net profit was $30.6 million (up 47% from the PCP) and the net profit for Nanosonics was $19.9 million (up 431% from the PCP). This places Clinuvel on a more attractive price-earnings (PE) ratio of 25 compared to 66 for Nanosonics.

Of particular interest, the profit margin (before tax) for Clinuvel (58%) was considerably higher compared to Nanosonics (13%). There are two reasons for this. The first is that Nanosonics employs almost 400 more staff than Clinuvel (482 versus 100). The second reason is the level of R&D spend, where last year Nanosonics spent $29.5 million on R&D compared to just $1.3 million spent by Clinuvel on clinical and non-clinical development. Clinuvel has always managed an efficient spend on R&D whist progressing multiple programs.

Considering recurring revenue: almost 100% of Clinuvel's revenue can be considered recurring, with 67% of Nanosonics' recurring revenue coming from consumable sales and service. This percentage excludes product upgrades for Nanosonics, with 1,800 upgrades for the year and a total installed base of 32,450 trophon units.

Outlook

A challenge for Nanosonics is to expand its geographical presence. Currently, 90% of Nanosonics' revenue is generated in North America. Nanosonics' growth path includes expanding into the disinfection of endoscopes (currently used to disinfect ultrasound probes).

A core challenge to Clinuvel's business originates from eventual competition in the EPP market. However after seven years of market exclusivity, there remains no immediate competition.

Clinuvel is working on diversifying its revenue from new products, as well as new versions of existing products, such as the instant-release version of afamelanotide for treatment of stroke, and for new applications. In a recent letter to shareholders, CEO Philippe Wolgen stated that the company is seeking to 'replicate several times over what it has done with Scenesse'.

The most advanced competitor in the market for EPP is Mitsubishi Tanabe Pharma America, with its oral drug candidate MT-7117. Mitsubishi has completed a 184 patient Phase III study with MT-7117. Patients in this study were offered to continue in an extension study. A total of 151 patients have remained on therapy with 18% electing not to continue with treatment. Some of the patients who elected not to continue in the study have moved on to treatment with Clinuvel's Scenesse.

The Phase II study and the Phase III study investigated two doses of MT-7117, 100mg a day and 300mg a day. However, the open-label safety study has now moved to a dose of 200mg a day. Given this change in dosing, an additional pivotal study may be required. The end date of the safety study has been extended by 15 months to the end of next year.

MT-7117 has side effects, including the development of freckles and some nausea. It has significantly inferior binding affinity to the melanocortin receptors than Scenesse (80 times lower) and given orally, its bioavailability is also considerably lower than that of Scenesse, which is delivered as a depot injection once every two months. Competition is unlikely to emerge for Clinuvel in the EPP before 2026 at the earliest.