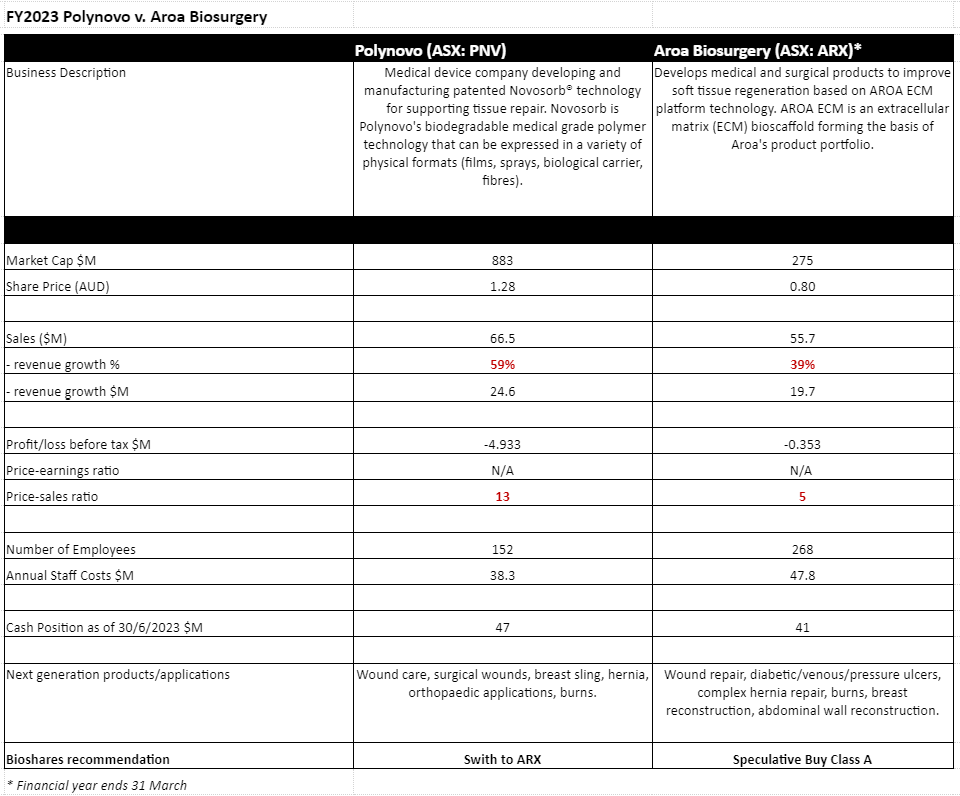

By most measures, except for net profit, Polynovo (PNV: $1.28) has delivered an exceptionally strong year in FY2023. Revenue has increased by 59% to $66.5 million, the numbers of hospitals/customers has increased by 168 to 638, and its staff numbers have also surged by 66 to 218.

At an investment briefing last week, chairman David Williams said that the expectation was that revenue growth for the current year should at least match last year's growth, and possibly exceed it. The company is obviously investing in top-line growth, with a net loss last year of $4.9 million, up from a $1.2 million loss in the PCP.

Of the company's 218 staff, around 170 are involved with sales and marketing of the company's wound care products.

Approximately 70% of Polynovo's revenue is derived from the US, where the average revenue per patient is US$8,500 a year. Unsurprisingly, this is substantially higher than outside of the US where the average revenue per patient is just US$2,000.

In 2020 Polynovo started selling in the UK, and now claims a dominant 45% market share. This is after having quickly displaced biologics, according to Williams. In Germany, the company also has a dominant position with 56% of the market. Polynovo is now expanding in Europe, selling and distributing to France and Italy.

In Hong Kong, Williams said that three in four major hospitals are buying the Polynovo product. In India, where biologics are too expensive, the company is preparing for market entry with a 20-person marketing team installed.

Williams said that the market is now finding new indications for the company's multiuse technology. In the US, the treatment of diabetic foot ulcers is beginning to gain traction, with patients effectively treated with the Novosorb synthetic wound healing product after three years of persistent ulcers.

Novosorb technology is 'infinitely programmable,' with the product bring fully biodegradable. The rate of degradation in the body can be customised. The next major application will be for implants, with applications including breast reconstruction and hernia reconstruction.

Similar Strong Topline Growth for Aroa Biosurgery

The end of Aroa Biosurgery's (ARX: $0.80) financial year (concluding 31 March) positioned the company with a robust cash balance of NZ$45 million, as well as on-target product revenues of NZ$60.5 million (guidance: NZ$60-62 million) and product gross margins of 84% (guidance: 84%).

While the company experienced a net loss of NZ$0.4 million, normalised EBITDA was profitable (NZ$1.5M) surpassing the guidance amount (guidance: breakeven). Additionally, total revenue growth was up 60% from FY2022, with a 55% increase in product sales. This follows an 81% growth in the previous year.

Myriad and Ovitex Driving Sales

Of the four product families developed by Aroa, there were three main contributors to the 55% growth (+NZ$21.5 million) in product sales. This includes a 12% increase in Endoform sales (+NZ$1.3 million), a 265% increase in Myriad sales (+NZ$10.2 million), and a 41% increase in OviTex sales (+NZ$10.5 million). OviTex sales are distributed through Aroa's partnership with TELA Bio.

This increase in product sales was matched by an increase in production capacity (+195%), and an investment into PP&E of just over NZ$2 million. Favourably, COGS has decreased by approximately 23% from the PCP.

Seeking to enter US$1 Billion Market with Enivo

Enivo™ is a medtech product designed to seal surgical cavities via post-surgery tissue apposition, using a single-use pump and an Aroa ECM implant. Aroa intends to develop and launch a new class of products utilising this new platform technology.

The current development of Aroa's Enivo™ technology absorbed an investment of NZ$7.0 million in FY2023. Excluding this investment in Enivo its EBITDA was a strong NZ$8.5 million.

This short-term sacrifice in profitability may place Aroa ahead in terms of long-term profit, as the estimated total addressable market of the Enivo product is greater than US$1 billion.

Enivo™ is currently not available for sale and Aroa is continuing to invest in R&D.

June Quarter Results

Aroa's first quarter for the new year (spanning 1 April 2023 to 30 Jun 2023) marks a stable launch to FY2024, with the company remaining on-target. Guidance for FY2024 is NZ$72-75 million in product sales, 85% gross product margin, and NZ$1-2 million normalised EBITDA, up from the PCP.

The projected rise in product sales is based on anticipated sales of the newly launched Symphony product (post-March 31, 2023). This is coupled with the strong performance of existing Myriad products, which are anticipated to be a key driver of sales.

Aroa's product sales in Q1 of NZ$15.2 million marks an increase of 9.4% compared to the results of the PCP (NZ$13.9 million). Additionally, the company has maintained its investments into Plant & Equipment, increasing to NZ$1.3 million in Q1 compared to NZ$1.1 million in the PCP.

Summary

Aroa's seven current clinical research initiatives have various end-dates, with most estimated to conclude before FY2026. Enivo™ is still yet to launch. Although the platform has gained FDA 510K clearance for the attached pump and catheter, the Aroa ECM component is yet to be approved.

Aroa had a strong cash balance of NZ$38.5 million at June 30. This has decreased by NZ$16.9 million from the PCP (NZ$55.4 million at June 30 2023).